KARACHI, Sep 5(ABC): The Pakistan Stock Exchange (PSX) witnessed bearish activity on Monday after some experts revised downwards the growth estimate for fiscal year 2023 and the government issued an estimate of the damages caused by floods.

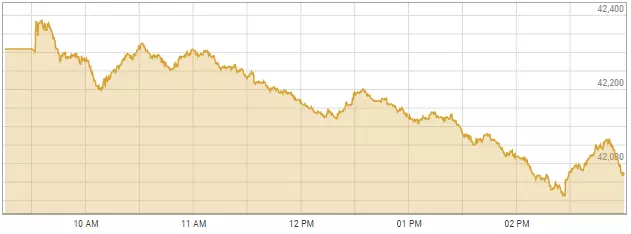

The KSE-100 index was down 333.58 points, or 0.79 per cent, to reach 41,975.53 points at 2:59pm.

Arif Habib Corporation’s Ahsan Mehanti said stocks were down on investor concerns over reports that the growth rate was revised to 2.3pc for FY23 while the finance ministry had estimated losses of $9.3 billion from the floods.

According to Topline Securities, GDP growth is expected to be in the range 2.5-3.5pc in FY23, revised downwards from their earlier estimates of 3-4pc.

“Weak global equities, dismal data on cement, oil and fertiliser sales in August and falling rupee played a catalyst role in bearish activity,” Mehanti added.

Meanwhile, First National Equities Limited Chief Executive Ali Malik said the volume of traded shares, as well as investor participation, was “very low” today due to political instability.

He added that investors were adopting a wait-and-see approach.

Last week, Finance Minister Miftah Ismail shared an estimate for damages caused by the floods, saying the economic impact would be at least $10bn, which is roughly equivalent to 3pc of the Gross Domestic Product (GDP) of the country.

Prime Minister Shehbaz Sharif has said that the recent floods caused more significant damage than the 2010 calamity. Due to the 2010 super floods, the economic growth rate had slowed by 2pc, and the financial losses were estimated at $9.7bn.

The unprecedented rains and floods, which have been ravaging most parts of the country since mid-June, have already killed more than 1,200 people and nearly 750,000 livestock, swept away major crops on swathes of farmlands, damaged over 6,000 kilometres of roads, razed over 1.2 million homes, and destroyed 243 bridges connecting different areas and regions of the country.