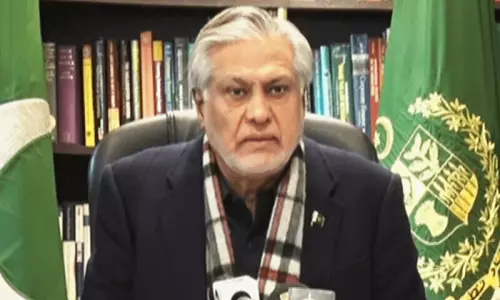

ISLAMABAD , March 10, 2023: Finance Minister Ishaq Dar on Thursday said a delay in the International Monetary Fund (IMF) programme in the tenure of previous government created a ‘trust deficit’ that is continuing to impact.

He said the PTI government failed to fulfill IMF commitments.

However, Dar said the incumbant government was trying its best to put the economy back on track and complete the IMF programme at any cost.

Talking to reporters in the federal capital, Dar said Pakistan was expected to sign staff level agreement with the International Monetary Fund (IMF) in coming two days.

Earlier addressing a seminar on “Reviving economic stability through strengthening of Public Financial Management” in Islamabad, the minister expressed the hope that Pakistan would sign staff level agreement with the global lender in coming days.

Dar said in past only PML-N government completed IMF program successfully. He said process of preparing economic and fiscal frameworks for fiscal year 2023-24 will start very soon.

Ishaq Dar said given the challenges presented by the current economic situation the upcoming budget will be a step in taking the country out of the economic quagmire.

He urged the participants to actively deliberate on major economic challenges and come up with policy recommendations and solutions for reviving economy.

The Finance Minister said Pakistan faced similar economic challenges in the past but we took the country out of the crisis. He said economic mismanagement in last few years has completely reversed the progress which country made in 2013-18.

Ishaq Dar said during 2016-17 Pakistan’s economy was ranked 24th in the world. He said imprudent policies of the last government pushed Pakistan into political crisis adding due to PTI’s policies foreign direct investment was reduced.

The Finance Minister said Prime Minister Shehbaz Sharif has recently announced austerity measures which will be adopted to control country expenditures.

He said that the government will welcome any suggestions from all political parties for a charter of economy.

Ishaq Dar appreciated Pakistan’s developing partners including World Bank and Asian Development Bank.

— Eyes on Saudi Arabia, WB and AIIB for revival of IMF loan deal —

With burden of sinking currency and decades-high inflation, Pakistan is now looking towards Saudi Arabia and the World Bank for more assistance to revive the much-need loan progamme of the International Monetary Fund (IMF).

The coalition government has recently taken drastic measures, including imposition of the additional taxes through mini-budget, to pull the worsening economy out of its deathbed. However, the struggle of the South Asian country is not ending as it would have to secure additional deposits of $2 billion and a $950 million loan from the World Bank and Asian Infrastructure Investment Bank (AIIB) to ink a Staff-Level Agreement (SLA) with the International Monetary Fund (IMF).

The officials of the ministry of finance are hopeful of the signing of the agreement in this week but the global lender was reluctant to announce any time frame for the deal.

China had already rolled two commercial loans worth $1.2 billion. The cash-strapped Pakistan is expected to receive more instalments of $500 million and $300 million Chinese commercial banks in the coming days that would help increase the level of foreign exchange reserves.

Pakistan eyes to jack up its foreign exchange reserves up to $10 billion till the end of June 2023 from current level of $4 billion.

The Shehbaz-led government is likely to resume virtual talks with the IMF on Monday to sort out upcoming expenditures and revenues and the stalled agreement for the release of fresh tranche under the ninth review of the Extended Fund Facility (EFF).

Led by its Pakistan mission chief Nathan Porter, the IMF team held talks with finance ministry officials for a couple of days, followed by a last meeting with tax officials on Friday to review the impact of prior actions in terms of revenue generation and their impact on bridging fiscal gaps.

Both sides will also review the draft Memorandum of Economic and Fiscal Policies (MEFP) — generally called the staff-level agreement (SLA).

The Federal Board of Revenue (FBR) has been tasked with collecting an additional Rs170bn in revenue to fill the gap, while the remaining amount will be abridged through other measures, such as removing subsidies and increasing gas and electricity prices.

— Dar rules out default, hints at IMF agreement next week —

On March 2, Finance Minister Muhammad Ishaq Dar had said Pakistan’s negotiations with the International Monetary Fund (IMF) were about to conclude and Staff Level Agreement with the fund is expected next week.

In a tweet, the finance minister said some Anti-Pakistan elements were spreading malicious rumours that Pakistan may default.

He said, these rumours were not only completely false but also belie the facts.

The State Bank of Pakistan’s (SBP) foreign exchange reserves have been increasing and are almost US $ 1 billion higher than four weeks ago despite making all external due payments on time, he added.

The finance minister said, the foreign commercial banks have started extending facilities to Pakistan.