KARACHI, Sep 20(ABC): Selling pressure continued to dominate trading at the Pakistan Stock Exchange (PSX) on Tuesday as the benchmark KSE-100 index extended losses from the previous session and recorded a decline of nearly 300 points.

A lack of positive triggers and the continuous depreciation of the Pakistani rupee forced investors to take a cautious stance and they resorted to profit-taking.

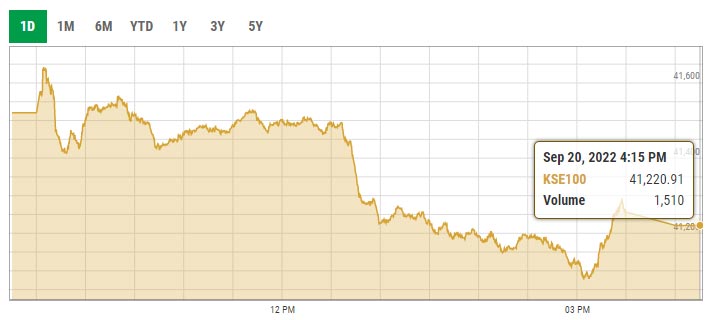

Earlier, trading began with a spike and market players poured investment into selected stocks, however, the KSE-100 index failed to maintain the momentum as bulls withdrew and bears took over.

At close, the benchmark KSE-100 index closed at 41,220.91 points with a decrease of 299.68 points or 0.72%.

A report from Arif Habib Limited stated that the market observed a negative session today as the US dollar continued its flight against the Pakistani rupee.

The benchmark KSE-100 index opened in the positive zone but failed to sustain in the green zone which led the index to an intra-day low of 441.88 points and close in the red zone.

Volumes remained decent on the main board whereas hefty volumes were witnessed in the third-tier stocks.

Sectors contributing to the performance included exploration and production (-123.2 points), technology (-57.8 points), banks (-27.3 points), cement (-24.1 points), and power (-23.6 points).